Third party food delivery is proving to be a tough business space with minimum option to differentiate, tight profitability margin and intense competition that is putting the industry in the process of more and more consolidation.

When Uber started and turned into something that people would use everyday, it became obvious that the idea of moving people from Point A to Point B with the help of an app would branch into Uber for other services like food delivery, groceries or any other parcel. The world of convenience economy was only about to expand. Like Uber, an app would connect merchants to consumers via riders. The app is a platform that help connect these three parties that are required to make a transaction and shipment.

The space that was ripe for disruption in this convenience economy was restaurants. Most restaurants didn't have their own delivery logistics. There were only few exception that you can think of that had their own delivery logistics. They had so because they solely relied on delivery or they were big enough to afford such logistics. Old players like GrubHub worked as more of an advertising service for the restaurants where the app would list items from different restaurants for consumers to order. Restaurants had to rely on their own delivery service in this ecosystem. Grubhub didn’t include delivery service until the year 2015.

An app that would show you every menu of every restaurant near your location, and would deliver the item you chose in minutes is something everyone saw coming. For this to happen, the apps didn't have to own restaurants and didn't have to employ people for ensuring the delivery service. Uber showed the way to do so in large scale.

And like Uber, the food delivery apps have the perks of scalability meaning an app can serve all the population of a country or even go beyond the border without the need to acquire physical assets or employ large number of people. But Making profit sustainably with these apps still seems a far cry.

Source: Bloomberg Second Measure

How Food Delivery Apps Make Money

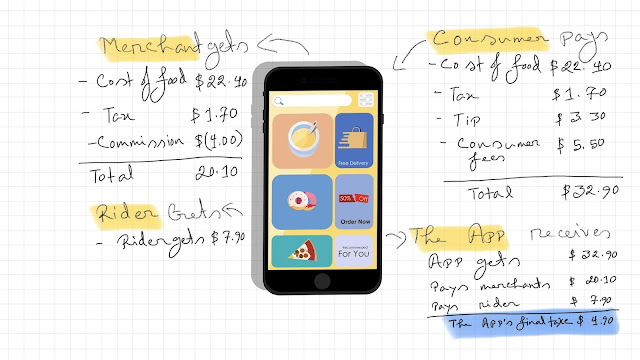

Food delivery apps make money by charging commission to restaurants and charging delivery fee to consumers. A part of this amount is spent as payout to riders who deliver the food. The final take for the platform is usually around 10.0%-15.0% of gross order value.

A food delivery app is a three sided marketplace. When a consumer posts an order on the app, he or she receives a bill which includes cost of the food (including tax), consumer fees for the service provided by the app and tip for the rider which is at the discretion of consumers.

Once the payment is received by the app, after a period, the app sends cost of food including tax to the restaurant from where the food was ordered only after taking its cut as commission which ranges between 10.0%-30.0% of the food price. Now the other part of the order value, consumer fees and tip for riders are mostly or fully paid to the riders for their services. So the app is fully relied on commission charged on restaurants for their income.

Unit Economics of Food Delivery Apps

Source: Example from DoorDash ProspectusHere commission charged on restaurants varies depending on different factors. Big restaurants which already have exposure to large customer base are charged lower commission while the smaller ones are charged higher commission.

Restaurants are also charged higher commission in exchange of higher prominence on the app meaning these restaurants will be listed higher on the app feed or search list on the app. Few extra bucks for more like an advertising service.

Pandemic was the time when restaurants that mostly rely on dining facility lost their bargaining power substantially. The only way they could survive was to rely on third party food delivery services. Most apps charged higher than usual commission to the restaurants.

The revenue that the apps earn charging restaurants commission fee and charging consumers delivery fee after subtracting the rider payout usually amounts to 10.0%-15% of gross order value. But the loyalty program, administrative expenses eat out this income leaving the companies in the red.

Even though companies like GrubHub pocketed full year profit in latest years but it was at the expense of lower growth due to underinvestment which is a red flag for a platform business in terms of sustainability and keeping up with the competition.

These apps need to continue to incentivize its customers to hold up or increase the traffic and provide good earning for the contractual riders to ensure rider liquidity which ensures smooth service. These apps use gamification strategy to ensure faster delivery from the riders' end. They offer additional rewards for faster delivery or for a certain value of delivery served in a day. These are the ploys apps use to keep their service superior than others which also burn a ton of cash.

These three parties, the merchants or restaurants, consumers and contractual riders enforce each other to help strengthen the network effect. In doing so, profitability comes under pressure for the app even after charging a good amount of commission on the restaurants.

How to Keep Consumers on the Apps

Consumers are usually indifferent to where they are taking their service from. They need to be continuously incentivized to keep them on the app. Most of the apps' consumers switch between apps to find different offers or discounts. So there is not much of loyalty among consumers.

In October 2019 letter to shareholder: Grubhub termed its consumers "promiscuous" meaning their consumers are not loyal to any one particular app and they switch between apps frequently.

Third party food delivery space also has local network effect. In certain areas one app has higher exposure than others. In USA, different apps are market leaders in different regions. While people in tier-1 cities are more willing to use a food delivery app, they are also more costly to serve. The restaurants in big cities have more bargaining power than the small restaurants in suburban areas which mean lower commission in the big cities. Moreover, the users in the big cities are more sensitive to service quality than suburban areas.

Tough Bargain for Restaurants

To compensate and generate substantial margin over these costs, the commission on restaurant fall way short. In usual time an app can not charge a restaurant higher commission over a certain level. Because most restaurants also have dining facility which require them to pay hefty rent and they also have permanent employees.

Cloud kitchens or ghost kitchens who work on a limited space to prepare the food are more willing to adopt third party food delivery space than the big restaurants even at a higher commission. That's why many food delivery apps are also investing in cloud kitchens services that provide space for setting up cloud kitchens with low cost.

Who Will Replace the Riders

The fault line of this economics is the rider part of the food delivery apps network. The cost for rider is attached to every delivery it makes. The logistics cost does not go down materially with increase in volume. And it's a cost that the apps have to bear to ensure rider liquidity which is crucial for making the delivery time fast and smooth.

Grubhub Letter to Shareholder (October 2019)

Regardless of the fault lines, apps are fighting for the dominance. Profitability is not the game they are playing at the moment. Because they know with scale more and more monetizable opportunities will arrive at their doors. With more and more dark kitchens or cloud kitchens, the apps will be able to pocket higher income in commission. In future they also expect to find cheaper alternative for the shipment service, be it drones, or self driving cars or any other technology that may replace contractual riders.

Sources (mentioned below):

1. Prospectus, Annual reports (10-K) and Shareholder Letters of Specified Companies

2. Bloomberg Second Measure